Blog

Increasing vehicle use throughout Africa has potentially large social, economic and environmental costs, particularly in urban areas caused by congestion, accidents and pollution. New research suggests that vehicle taxes in the region commonly fail to address these issues, which are applied predominantly to vehicle imports rather than ownership or usage. Instead, a progressive recalibration of taxes can improve health and transport systems, in many cases raising much-needed revenue for domestic priorities.

Although vehicle ownership rates in sub-Saharan Africa are, on average, only 10% of the global average, the number of cars and motorcycles in the region is growing fast - particularly in countries where incomes are rising and the middle class is growing fast.

Motorisation allows individuals and businesses to connect over greater distances in less time, but the vehicles on African roads also carry huge costs. Time lost sitting in traffic jams costs major African cities like Lagos and Nairobi around 5% of local GDP, compared to less than 1% for London and New York. Deaths per capita from air pollution in sub-Saharan Africa are 60% higher than the global average, and deaths from road accidents are 75% higher.

Governments need to design policies to manage these costs alongside the potential benefits of motorisation. Effective regulation and infrastructure investment have a role to play, but as we set out in a recent report, there is also a strong case for using taxes, since congestion, pollution and road accidents represent social costs that result from decisions taken by individual drivers. For example, somebody driving onto a busy road typically does not consider the fact that they slow down everyone else’s journey. Motoring taxes provide a way of putting a price on these social costs, effectively forcing drivers to take into account the negative effects of their driving.

These taxes also raise revenue. Most African governments have a need to raise substantial additional revenues to meet their development goals, especially post-COVID. Taxes on vehicles and fuel are a highly progressive source of revenue in the vast majority of countries in the region, as vehicle ownership is heavily concentrated among richer households.

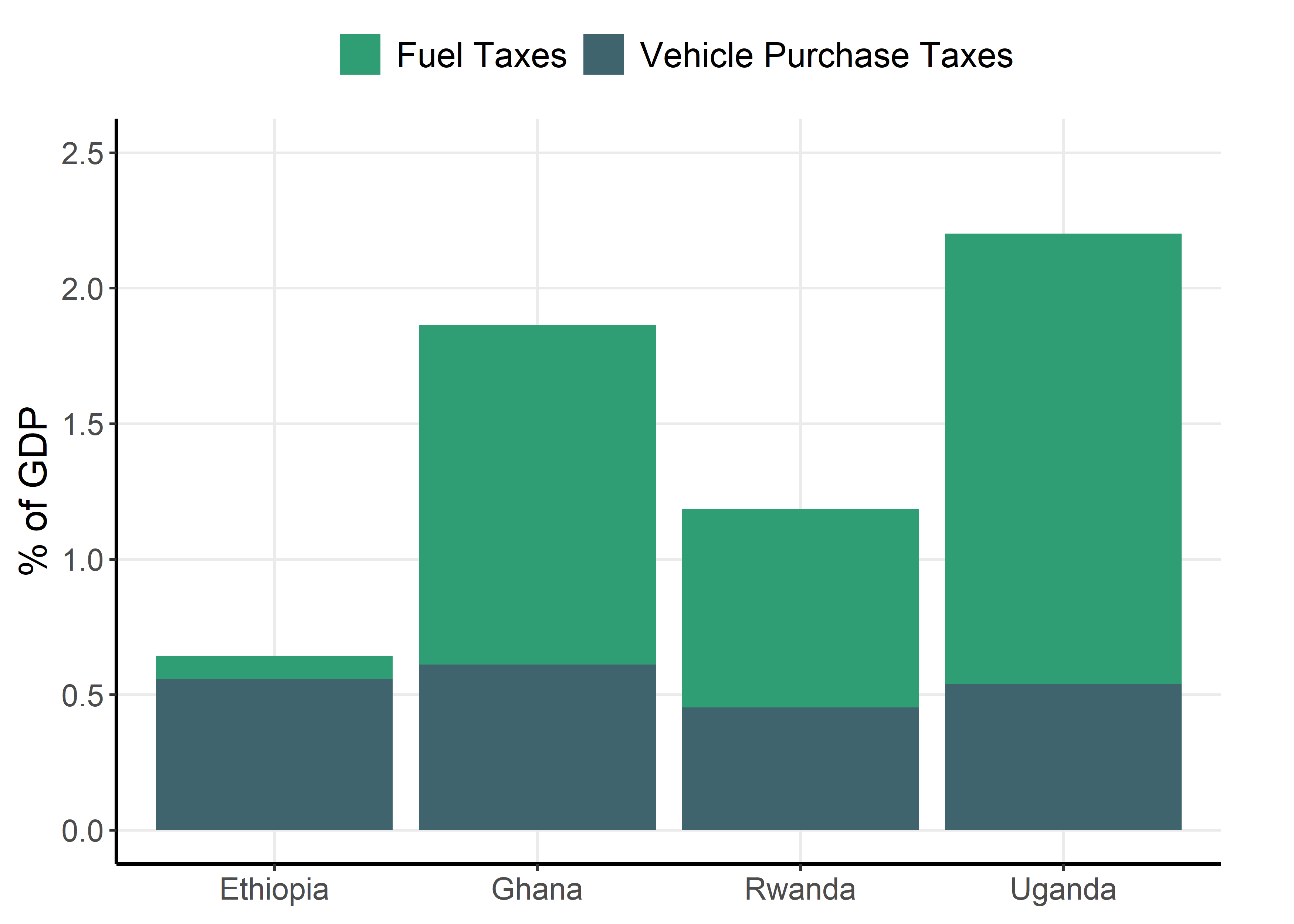

Indeed, motoring taxes already do raise a substantial amount of revenue in some sub-Saharan African countries. In a sample of countries where we could compile revenue data, fuel and vehicle purchase taxes raise revenues equivalent to 0.5%-2.2% of GDP (Figure 1). Some countries in the region, such as Liberia and Angola, have low tax rates on both vehicle and fuel purchases; in such cases, there is likely to be untapped revenue potential.

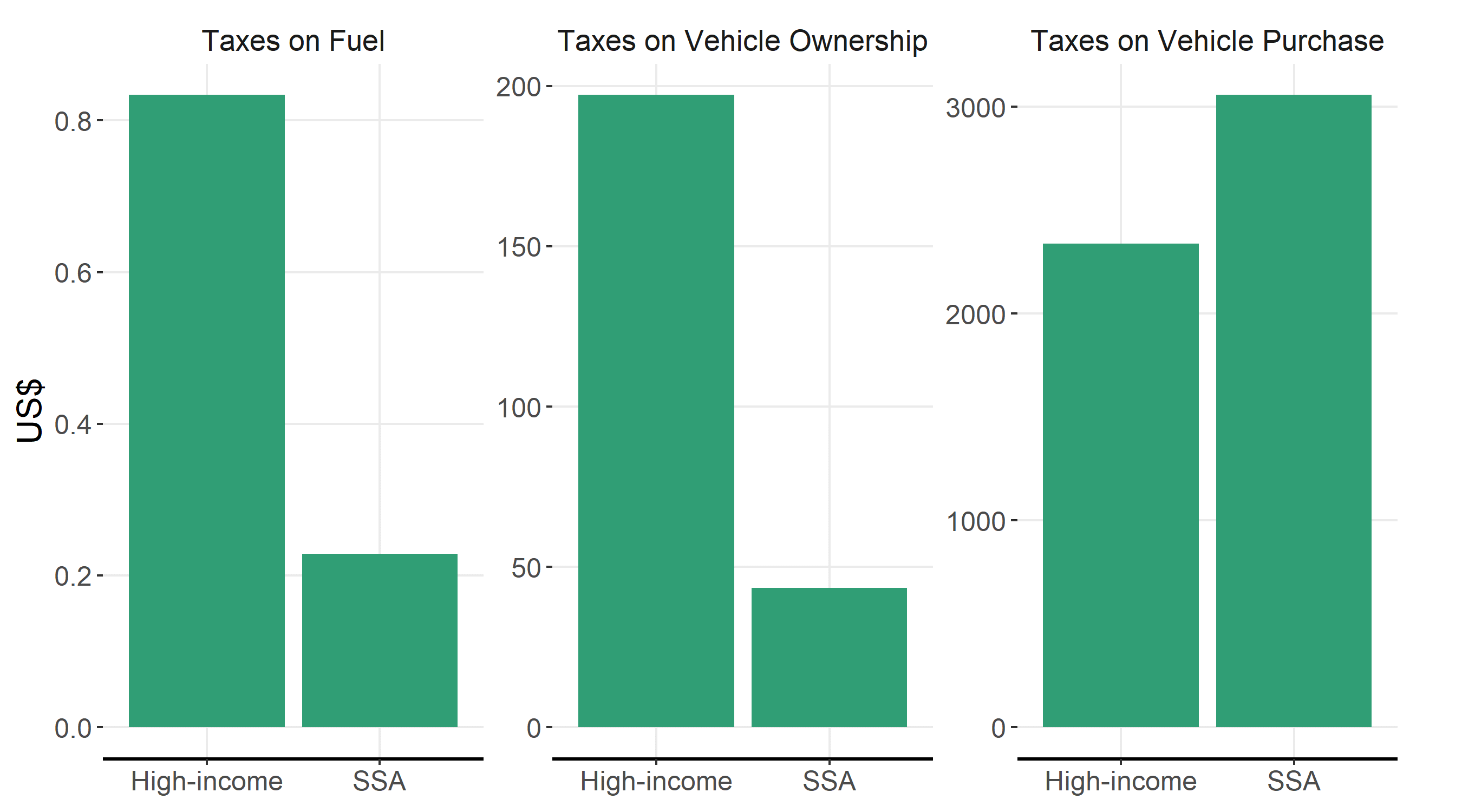

Despite these tax revenues being substantial, taxes on motoring in most sub-Saharan African countries are not well-designed for managing the social costs generated by vehicles. Figure 2 compares average tax rates on vehicles and fuel in high-income countries to those in this region. Fuel taxes are based on a litre of gasoline with a pre-tax price of $0.50, and vehicle purchase and ownership taxes for a mid-sized car with a value of US$5,000 (see the report for the full methodology and data broken down for all sub-Sahara African countries).

Compared to high-income countries, motoring taxes in the region are generally heavily tilted towards taxes on vehicle purchases. Taxes on fuel and vehicle ownership are, on average, around a quarter of those in high income countries, however. Tax levels probably should be lower in sub-Saharan Africa, reflecting lower local incomes and purchasing power, but this only makes the fact that vehicle purchase taxes are higher in the region than in high-income countries even more striking. Many of these countries have high vehicle purchase taxes as they are administratively simple, being levied at the point of import for imported vehicles.

However, vehicle purchase taxes miss the fact that the main costs of motoring are generated by vehicle use. A parked car does little harm. While vehicle purchase taxes reduce demand for new vehicles, drivers are not discouraged from driving as much as they want once the vehicle is purchased, contributing to congestion and pollution.

Fuel taxes are more effective at targeting these costs since fuel consumption increases with the distance driven, and they also encourage drivers to purchase more fuel-efficient cars. Ownership taxes do not directly target vehicle use, but they can be designed so that they are lower for cleaner cars, encouraging drivers of older, dirtier vehicles to trade in for newer vehicles.

Tax policies focussed on purchases give the wrong incentives for drivers. Consider the case of Ethiopia. The tax rate on imported vehicles (most vehicles are imported) can be 500%, meaning a vehicle that costs $5,000 before taxes can cost an incredible $25,000 after taxes. In contrast, annual ownership taxes are effectively zero, and in recent years fuel taxes (for which only a fraction of the official rates are actually collected) have generally been more than offset by subsidies via a price stabilisation mechanism. Drivers have a strong incentive to keep vehicles, once they are imported, on the road for as long as possible, resulting in a stock of old, high-emission and potentially dangerous vehicles. As the UNEP have reported, poor vehicle quality is a problem across the continent.

A shift away from purchase taxes, and towards fuel and ownership taxes, would be a step in the right direction to manage Africa’s rapid motorisation. Of course, tax reform is difficult. African governments may be wary of raising fuel taxes in particular, with protests against fuel price rises commonplace on the continent. Successful fuel tax reforms are generally gradual, and include measures to help the poorest and worst-hit. Annual vehicle ownership taxes require new systems and up-to-date vehicle registration information, and governments need to be aware of the risk of evasion.

Motoring tax policies also have to be sensitive to the rural-urban divide. In most of sub-Saharan Africa, vehicles are heavily concentrated in urban areas. For example, Lagos is home to 42% of Nigeria’s cars, despite only having 7% of Nigeria’s population. For rural areas, the problem can often be too few vehicles, hampering access to markets, health and education. This suggests considering policies that target vehicle use in urban areas, such as higher vehicle ownership taxes for urban regions, parking charges and, perhaps, even congestion charges in the very largest cities.

Although reform is difficult, the prize is great. Tax reforms, combined with regulatory policy such as improved licensing, better public transport and better urban design have the power to make African countries cleaner, safer, and more productive, while in some cases also raising much-needed revenues.

This blog was first published by Africa at LSE and is reproduced here with kind permission.

Published on: 29th October 2021

Print