Blog

This blog for Stone Econ summarises the findings of recent research on the impact of COVID-19 on formal firms.

When the COVID-19 pandemic hit and triggered lockdowns around the world, it was clear that the effects on firm profits and hence tax payments would be significant. To prepare support policies, governments, aid agencies and NGOs were wondering just how severe the impact would be. The need for well-informed policy design seemed particularly acute in lower-income countries. Yet data on firm activities is typically scarce in these countries. We devised a method to simulate the impact of COVID-19 triggered lockdowns on the profits of formal-sector firms, using available corporate tax records. We applied our approach to data for ten countries.

We simulate a demand shock which induces a drop in firms’ sales for the duration of the lockdown. The severity of the shock is set to differ across economic sectors. We assume that firms produce a unit of output with a Leontief production function which requires capital, labour and material inputs in fixed proportions, with the proportions estimated from each firm’s tax declaration. In our very stylized world, firms can reduce their material costs proportionally to the drop in demand; they reduce labour costs only when making losses because re-contracting workers is costly; and they cannot adjust their fixed costs.

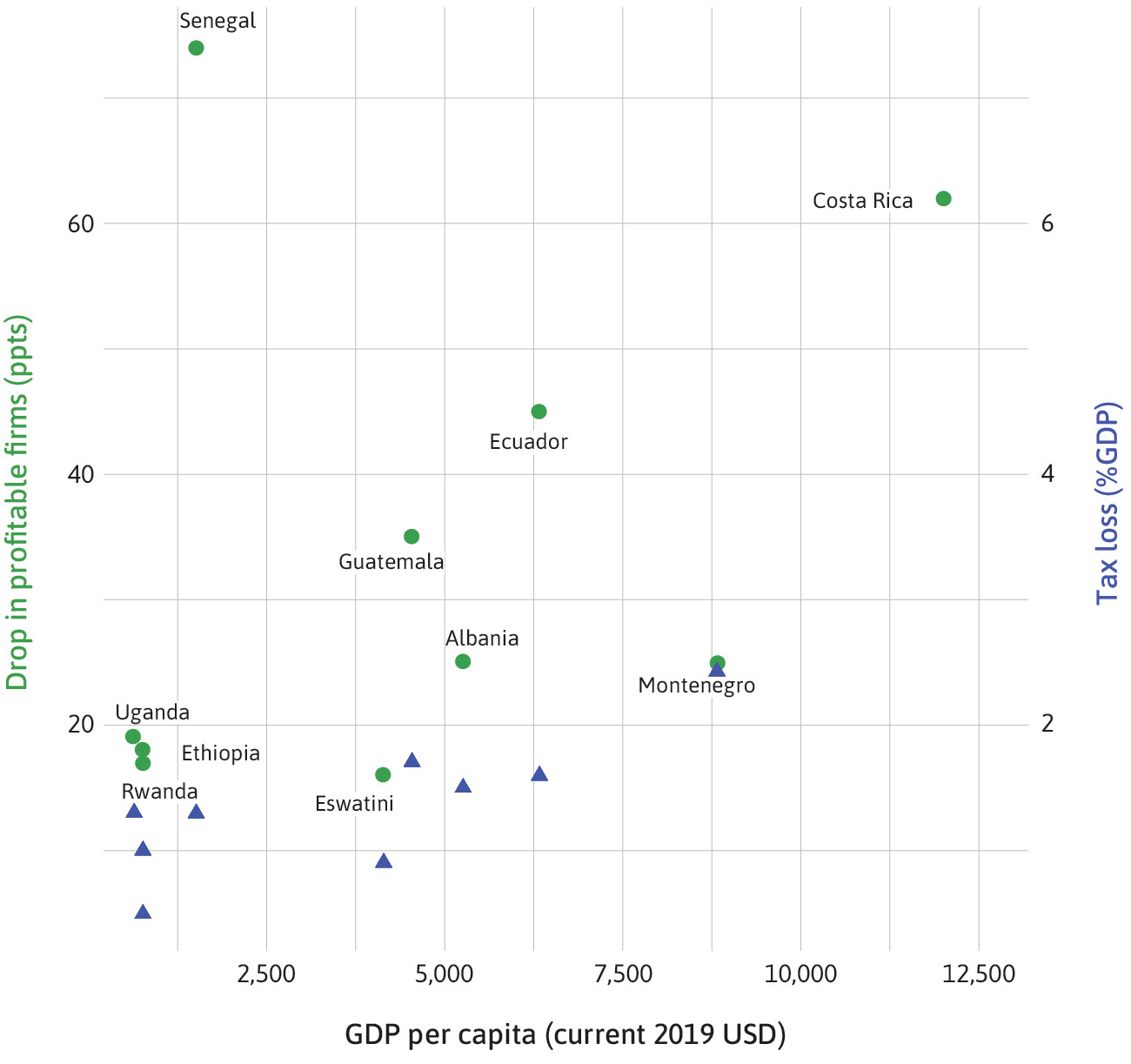

We predicted that less than half of all firms would remain profitable by the end of 2020, about 5–10 percent of the formal aggregate annual wage bill would be lost, and the likelihood that firms exit the formal sector would double. As a result, we expected that tax revenue remitted by the corporate sector would fall by about 1.5 percent of baseline gross domestic product, and aggregate corporate losses would increase by at least 50 percent in all but two countries in our data.

The figure plots the simulated drop in profitable firms (measured in percentage points, on the left-hand side) and the tax loss (measured as a share of GDP, on the right-hand side) induced by a 3-month lockdown, for countries at different income levels. The figure highlights cross-country differences in the predicted effect of COVID-19, where higher GDP per capita levels are correlated with larger negative shocks on profitability and tax revenue. What explains the differences across development levels? First, the formal sector is substantially larger, as a share of GDP, in richer countries, which therefore have more to lose. Second, effective tax rates are on average higher. Third, the industrial composition of middle-income countries implies on average a slightly larger shock, as services (e.g. tourism) are more impacted than agriculture and manufacturing.

This work highlighted cross-country differences in the predicted effect of COVID-19 and in the effectiveness of support policies. Wage subsidies were expected to be less effective in low-income countries and government revenue losses smaller. These findings are driven by differences in sectoral composition and in firms’ cost structures across countries. Firms in low-income countries disproportionately operate in sectors less exposed to the lockdown-triggered shock (e.g. agriculture is less affected) and rely less on formal labour.

We are currently working on comparing the results of our simulations to the realized impact of COVID-19 on firms, using tax return data for 2020, which is now available for about half of the countries we studied.

This paper can be cited as follows: Bachas, P., Brockmeyer, A., and Semelet, C. (2021) 'The Impact of COVID-19 on Formal Firms: Micro Tax Data Simulations Across Countries.' World Bank Policy Research Working Paper 9437.

This blog was first published by the Stone Centre at UCL, and is reproduced here with kind permission.

Published on: 11th August 2022

Print